Another Korean supermarket has completely withdrawn from China, but it has left a hand.

According to Korean media reports, after 24 years of continuous expansion, emart (e-mart), a large discount supermarket owned by Shinsegae Group of South Korea, began to streamline its business, and recently said that it would completely withdraw from China by the end of this year.

Emart pointed out that due to the poor performance, the company has decided to close all the six remaining stores in the China market.

After years of huge losses, e-mart finally came to an end.

It is reported that emart has been losing money in China market for many years. As early as 2011, the loss of emart in China market has exceeded 100 billion won (about 88 million US dollars). In the next four years (2012-2016), due to the rising operating costs and weak market demand, its accumulated losses reached 150 billion won (about 133 million US dollars), reaching the point of "unable to survive".

According to public information, emart first entered the China market in February 1997, and opened the first "e-mart" supermarket in Shanghai. Later, it opened more stores with Jiangsu, Zhejiang, Tianjin and Beijing as the centers. At that time, it was announced that it would open 1,000 stores in China. By 2010, its total number of stores in China reached 27.

(e-mart Supermarket, which was once lively)

However, at this point, e-mart supermarkets can no longer open.

In 2011, the development of emart in China market suffered from "Waterloo", and 12 stores were closed at one go. By 2014, the number of its China stores has been reduced to 10; There were only 7 in November 2016; In March this year, it was announced that there were only six stores in the Old Ximen District of Shanghai. Today, the last six companies can’t keep it, and they will be evacuated one after another this year.

At present, there are 7 stores that can be selected when logging in to official website, China, e-mart, including Shanghai Laoximen Store, but the whole website is in a state of almost no maintenance. No matter which store you choose, the page display will be the same. Except for the two channels of "Poster Commodities" and "Store Promotion Commodities", the two channels of "New Commodities" and "e-mart Special Sale" are completely blank.

(e-mart, China and official website)

(Some channels in official website, e-mart are completely blank.)

In addition, the focus map on the homepage of the website also shows the publicity page of the 20th Anniversary Celebration (April 19th to May 2nd). Because this year is the 20th anniversary of the opening of Quyang Store in e-mart. However, this time seems a bit bleak, and the 20th anniversary has also become the "drama ending day".

Internal and external factors doomed this tragedy?

Looking back on the development of emart in China market, it seems that both internal and external factors doomed the closure of e-mart supermarket.

"Korea Economic Daily" concluded: e-mart Supermarket has never been successfully established, one of the important reasons is the poor geographical location of the store, which is attributed to its late entry into China. At the same time, compared with other retailers, e-mart’s prices and goods are not competitive. This is the failure of its own business strategy.

In addition, it is an indisputable fact that the format of China’s hypermarkets has entered a "downhill" several years ago. In recent years, the adjustment of store closing and transformation has been the main theme of this industry. In addition to the frequent news of store closing by local merchants in China, foreign giants such as Carrefour and Wal-Mart are also constantly "slimming down", and Lotte Mart, a Korean compatriot of emart, has also completely withdrawn from China this year.

An insider pointed out that, in fact, from the perspective of the whole retail industry, the market is increasing, and the situation of each format and each enterprise is different. "Those enterprises with high level of refinement, strong innovation ability and rapid transformation and upgrading will get out of the predicament faster, and vice versa."

Obviously, for so many years, emart seems to have never found the crux of its difficulties in the China market. Or, it has found the crux, but it has been unable to save it.

However, despite repeated defeats in China, in recent years, emart’s expansion in the whole overseas market is still very positive. When it announced its complete withdrawal from the China market, its officials mentioned that the company would shift its focus to fast-growing markets such as Viet Nam and Mongolia.

Previous media reports have pointed out that emart began to export to the Philippines in January this year, opened up the Japanese market in March, and entered the UK in April. Since then, the company plans to enter Thailand, Uzbekistan, Russia, the Netherlands and other places one after another. The goal is to earn more than 100 billion won (about 86.5 million US dollars) in overseas markets by next year.

It is not difficult to see that finding a way out in other countries may be an important measure for emart to make up for the market failure in China.

Change your skin and stay in China

It is worth noting that in recent years, under the background that all kinds of overseas supermarkets have entered China through e-commerce channels, emart can’t give up this fat piece of China market after all. Although all offline stores (e-mart Supermarket) will be closed soon, its online business (except official website, China) is still going on, but it has changed into a cross-border e-commerce mode.

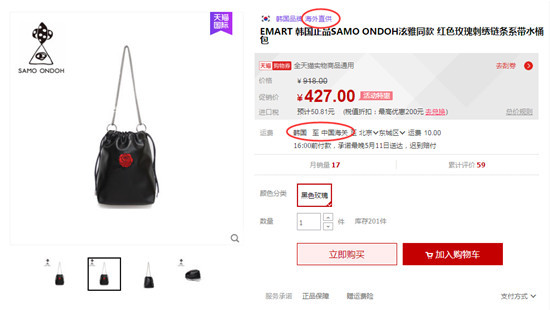

It is understood that in 2015, when the offline business was "gone", emart caught up with the enthusiasm of cross-border e-commerce and chose another way to enter China: in July 2015, it joined hands with Netease Koala, and in October 2015, it settled in Tmall International to open the "emart official overseas flagship store".

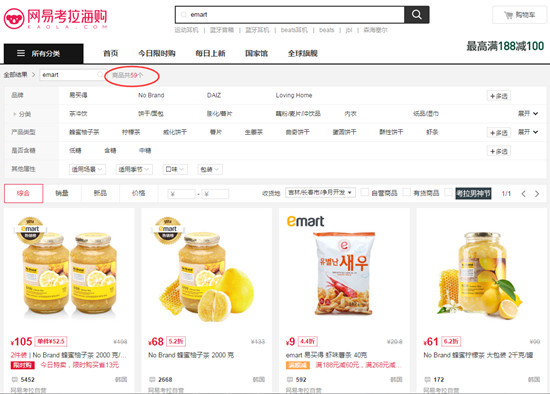

At present, its business in Tmall International and Netease Koala is operating normally. When we open the official overseas flagship store of Tmall International emart, we can see that it provides goods to China consumers in two cross-border e-commerce modes: "overseas direct supply" (that is, overseas direct mail) and "bonded warehouse delivery", covering nine categories, including personal care, food and beverage, skin care and beauty, household daily use, kitchen appliances and maternal and child products. In Netease koala search "emart", you can find 59 products, all of which are self-operated by Netease koala.

(Tmall International emart official overseas flagship store home page)

(emart official overseas flagship store overseas direct mail goods)

(emart official overseas flagship store delivers goods from bonded warehouse)

(emart products of Netease koala)

According to previous media reports, Cui Yu, vice president of emart’s parent company, New World Group, publicly said in 2015: "We have a hard time in the offline market in China, but the development possibility in the online market in China is growing."

He pointed out that entering the e-commerce market in China is the latest move of emart to adjust its global asset portfolio, and said that "Korean offline consumers+global online consumers" will become the new strategic direction of global layout of emart in the future.

In fact, after staying in the China market through cross-border e-commerce, emart did taste some sweetness.

In double 11 in 2015, emart, who just settled in Tmall, was ranked 13th in the TOP20 list of pre-sales of Tmall international stores with a total amount of 8,157,740 yuan. But also take this opportunity to launch a number of self-owned brands in double 11.

In Tmall International, emart’s official overseas flagship store, as a representative business of "Korea Pavilion", has gained a lot of exposure opportunities. It is not difficult to find that the sales of its products are relatively hot by opening the product page of its store — — The total sales of the five most popular products are 120,000+,70,000+,60,000+,50,000+and 30,000+,and the sales of other products are also higher among peers. In Netease koala, many emart foods and daily necessities are also among the popular products.

In addition, at the Tmall International Global Merchants Conference held on the 18th of this month, emart also entered the list of "Billion Dollar Clubs" officially announced by Tmall International (that is, merchants whose sales exceeded 100 million dollars), and cooperated with Chemist Warehouse, Costco, Macy’ S, Matsumoto Kiyoshi, Sainsbury’ S, Metro and others stood in the first camp together.

However, in recent years, few overseas supermarkets have really had the last laugh. Emart’s Korean compatriot LOTTE’s "despondent" withdrawal from Tmall in March this year is also a lesson from the past.

A senior practitioner once bluntly told Billion Power Network: "Few overseas businesses can deeply understand Ali’s complex ecosystem, and they don’t understand the operation logic of China e-commerce. A large number of enterprises are coming in, and the platform resources are not enough. In the end, it is inevitable to grasp the big and put the small. Many overseas merchants come to Tmall and I am afraid they will run with them in the end. "

Obviously, emart, who changed into a cross-border e-commerce bag and stayed in China, still faces many strong enemies, and the future development path is full of uncertainties. Whether this transformation can finally be achieved still needs to wait and see.