The jiacang exceeds 40 billion, and foreign investors can’t stop buying in the New Year! "Persuade to buy a house" expert: not forcing low-income families to buy a house! What is the impact of Paxlovi

A-shares adjusted back today, the Shanghai Composite Index fell slightly, and the GEM and Kechuang 50 Index fell more than 1%; Hong Kong stocks rose strongly in early trading and fell back in the afternoon. The Hang Seng Technology Index once fell nearly 1%.

Specifically, in terms of A-shares, the Shanghai Composite Index fluctuated strongly in intraday trading, and turned green at the end of the session. The GEM Index and the Kechuang 50 Index plunged sharply. At the close, the Shanghai Composite Index fell 0.24% to 3161.84 points, the Shenzhen Component Index fell 0.59% to 11439.44 points, and the Growth Enterprise Market Index fell 1.13% to 2445.97 points. The total turnover of the two cities was 741.8 billion yuan, equivalent to yesterday; Northbound funds are not afraid of the index correction, but still flow in strongly, with a net purchase of about 7.6 billion yuan for the whole day. Since January, they have accumulated more than 40 billion yuan.

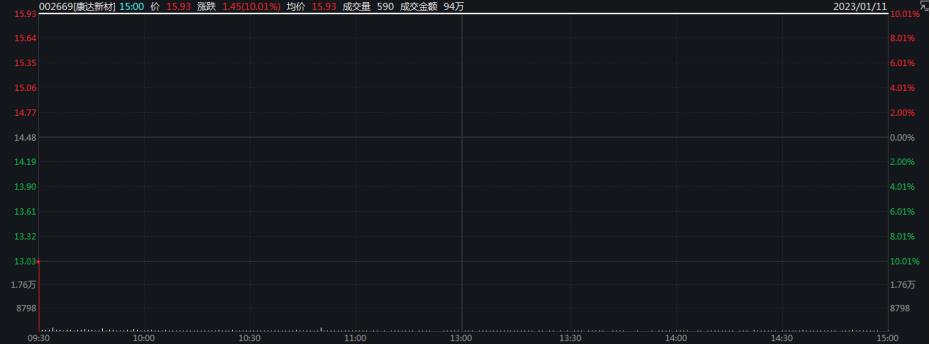

Today, most of the sectors in the two cities are lower, with tourism, software, semiconductors, wine-making and automobiles all falling. Huguang shares and Xiaoyan shares have fallen, and Fudan Microelectronics has fallen by 10%. The coal sector rose against the trend, and Shaanxi Black Cat and Zhengzhou Coal and Electricity had daily limit; The concept of baby broke out, and Annabel and blond rabbi went up daily; In addition, a number of pre-increased performance shares have been sought after. Tony Electronics and Electronic City have gained three consecutive boards, and Shiyida and Kangda New Materials, which released good performance yesterday, have daily limit. In addition, Tongda Power, which supplies BYD, has performed brilliantly in recent days, and has gained 5 boards today.

In terms of Hong Kong stocks, the two major stock indexes rose strongly in early trading, but fell back in the afternoon, and the Hang Seng Technology Index turned green. At the close, the Hang Seng Index rose 0.49% to 21,436.05 points, and the Hang Seng Science and Technology Index fell 0.25% to 4,547.12 points. In terms of individual stocks, BYD shares rose nearly 5%, Tencent and Alibaba rose more than 3%, and Zhou Heiya plunged about 23%.

Many performance pre-increased stocks rose sharply.

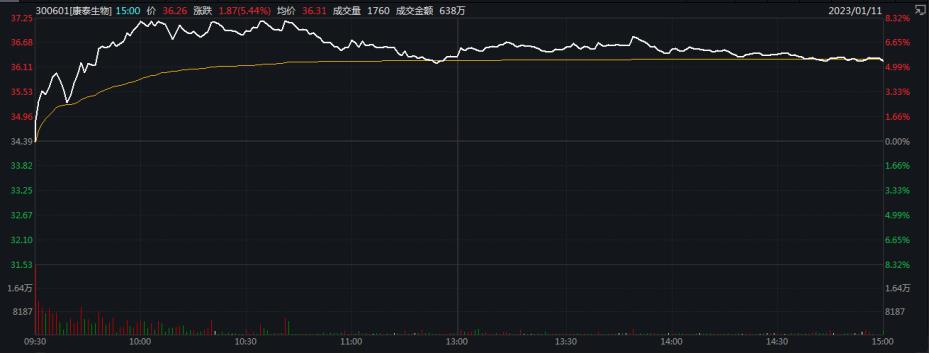

A number of stocks with a substantial pre-increase in net profit in 2022 have recently been sought after by funds. For example, Dongni Electronics and Electronic City have been trading daily for three consecutive trading days; Shiyida and Kangda New Materials, which disclosed the performance forecast last night, both had daily limit. It is worth mentioning that Kangtai Bio, which suffered a big loss in advance, also rose sharply today.

Tony Electronics has been trading daily for three consecutive trading days. At the close, the stock reported 80.65 yuan, approaching a record high.

Tony Electronics disclosed its performance forecast on the evening of the 9th. It is estimated that the net profit attributable to the owners of the parent company will be 100-110 million yuan in 2022, up by 199.28% to 229.2% year-on-year. It is estimated that the net profit after deducting non-profit in 2022 will be 62.33 million yuan-72.33 million yuan, an increase of 344.89%-416.27% year-on-year.

The company issued a risk warning last night, saying that there are two main reasons for the pre-increase of the company’s 2022 annual performance: 1. The main business impact: the operating income and gross profit of consumer electronics, photovoltaics, medical care and new energy businesses have all improved; The company’s export products are mainly settled in US dollars. Due to the appreciation of the exchange rate of US dollars against RMB, exchange gains are generated in this period, while exchange losses are generated in the same period of last year. 2. Impact of non-operating profit and loss: The government subsidy in this period increased compared with the same period of last year. The company reminds investors to pay attention to production and operation risks.

The company also said that the Purchase Contract signed by its subsidiary Tony Semiconductor and its downstream customer T stipulated the delivery quantity, unit price, specifications, acceptance criteria and liability for breach of contract, among which the final unit price and delivery time of products in 2024 and 2025 will be determined through consultation in the fourth quarter of the previous year, which has uncertainty on the company’s future financial status and operating results. In the subsequent performance of the contract, in case of macro-policies, market environment, product quality, operation management and other factors, the contract may not be fully performed or cancelled as scheduled, and it shall bear corresponding liabilities for breach of contract and compensate liquidated damages.

Electronic City also had a daily limit for three consecutive days. At the close, the stock reported 5.27 yuan, and nearly 1 million orders were sealed on the daily limit. The company disclosed its performance forecast in the evening of June. The company expects the net profit attributable to shareholders of listed companies to be 470 million yuan-680 million yuan in 2022, an increase of 1388.52%-2053.6% year-on-year.

Shiyida disclosed its performance forecast last night. It is estimated that the net profit attributable to shareholders of listed companies in 2022 will be 120 million yuan-170 million yuan, a year-on-year increase of 225.88%-278.33%. According to the company, during the reporting period, the company steadily pushed forward the layout and business adjustment of various business segments according to the strategic plan, continued to deepen the smart hardware business, sought a breakthrough in upgrading the smart hardware business, continued to promote open source and reduce expenditure, reduced the product cost of the company, and provided more value-added services to customers. The company’s smart hardware performance increased steadily this year.

Kangda New Materials also disclosed its performance forecast last night. It is estimated that the net profit attributable to shareholders of listed companies in 2022 will be 45-55 million yuan, an increase of 104.58%-150.05% over the same period of last year. After deducting non-recurring gains and losses, the net profit was 30,672,600 yuan-40,672,600 yuan, an increase of 463.56%-647.3% over the same period of last year. The company said that during the reporting period, the prices of raw materials of the company’s main products showed a downward trend, which played a positive role in the recovery of the company’s performance; At the same time, the company actively implemented cost reduction and efficiency improvement, optimized operational efficiency, and continuously improved profitability, so that the company’s operating performance is expected to increase compared with the same period of last year.

It is worth noting that the share price of Kangtai Bio, which predicted a big loss last night, also rose sharply today, with the highest intraday price exceeding 8%. At the close, the stock reported 36.26 yuan, up 5.44%, with the latest market value of 40.6 billion yuan.

Kangtai Bio disclosed its performance forecast last night. It is estimated that the net profit attributable to shareholders of listed companies in 2022 will be a loss of 76 million-150 million yuan, down 106.02%-111.87% year-on-year. The company pointed out that during the reporting period, due to major changes in the vaccination environment in COVID-19 at home and abroad, the company’s COVID-19 vaccine sales dropped sharply compared with the previous year. At the same time, in accordance with the relevant provisions and requirements of the Accounting Standards for Business Enterprises, the company made provision for asset impairment of COVID-19 vaccine-related inventory goods, raw materials, self-made semi-finished products, production equipment and COVID-19 inactivated vaccine development expenditure in 2022, and spent 303 million yuan on clinical research and development expenditure of COVID-19 inactivated vaccine. The above factors reduced the total profit by 1.088 billion yuan, and the net profit was reduced by 816 million yuan.

The coal plate rose against the trend

The coal sector rose against the trend. At the close, Shaanxi Black Cat and Zhengzhou Coal and Electricity had daily limit, Lu ‘an Huaneng, Yankuang Energy and mountain coal international rose over 7%, and Jinkong Coal, China Coal Energy and China Shenhua rose over 5%.

Besides, Yankuang Energy, Yitai Coal, China Coal and China Shenhua listed on the Hong Kong Stock Exchange rose by about 9%, nearly 8% and nearly 5%, respectively.

In the news, yesterday, China Coal Industry Association and China Coal Transportation and Marketing Association issued a proposal on ensuring coal supply during the Spring Festival, proposing to give priority to coal supply and make emergency preparations. The coal transportation and marketing department should further improve its political position, always establish the awareness of ensuring the supply and price stability of coal, and give priority to ensuring the supply and delivery of coal in long-term contracts. At the same time, it is necessary to keep abreast of downstream users’ demand and inventory status, pay close attention to changes in the market situation, actively maintain the operation order of the coal market, and respond to the national emergency supply guarantee task in a timely manner.

Open source securities said that the coal industry is affected by both supply and demand, but it will also face the weak reality of supply in the first quarter, and the weak supply and demand will lead to the high coal price. At present, coal stocks have been fully adjusted, which implies the expectation of weak economy in the first quarter. In addition, they have high dividends and low valuations, which are not only attractive, but also have a high enough safety margin, both offensive and defensive. In addition, Guanghui Energy recently disclosed that the company’s net profit in 2022 is expected to increase by 126%-130% year-on-year, and the performance forecast of other coal enterprises’ annual reports in 2022 will be gradually disclosed. 2022 is a year of rapid profit growth in the coal industry, and the unexpected performance is also expected to catalyze the market.

A piece of news explodes the concept of baby.

The concept of baby rose in intraday trading. At the close, Rabbi Blonde and Anna Nair had daily limit, mygym rose by nearly 6%, and king of the children, Baby Friendly Room and Gaole shares all strengthened.

The concept of assisted reproduction has also been manifested, with Shengnuo Bio and Hanshang Group rising by over 7%, while Orrit and Aoyang Health rising by over 4%.

In the news, recently, the Shenzhen Health and Health Commission publicly solicited opinions on the Measures for the Administration of Parenting Subsidies in Shenzhen (Draft for Comment). The "Administrative Measures" proposes that if a child is born after 0: 00 on the date of the formal implementation of the measures and is born in the Shenzhen Public Security Department, the child development allowance will be counted from the date of the child’s birth until the child reaches the age of 3; After being born into a household, you can apply for a one-time maternity allowance and a child-rearing allowance issued year by year.

In addition, a few days ago, the Central Economic Work Conference gave important instructions on social issues such as China’s birth policy and old-age service, and proposed to improve the birth support policy system, implement the policy of gradually delaying the statutory retirement age in a timely manner, and actively respond to the aging population and declining birthrate.

According to the agency, in recent years, in the face of the decreasing birth rate of newborns and the increasing aging rate, "one old and one young" has become the core issue of social policy. The state gradually adjusts the birth policy, gradually liberalizes the second and third births, improves the birth support policy, and enhances the social birth will.

Guojin Securities believes that with the continuous loosening of the birth policy, the demand for multiple births in China will be released, and the infant-related products that are expected to benefit directly in the short term, among which fast-moving consumer goods will benefit more than durable consumer goods, such as infant milk powder and skin care products, followed by infant clothing, etc. At the same time, it will also drive the relevant retailers to speed up their development (such as offline baby products retailers and cross-border e-commerce maternal and child plates, etc.) and the demand for improvement of large-sized housing will also increase. In the medium and long term, with the increase of the age of newborns, the population of children and adolescents will increase accordingly, and children’s toys and entertainment consumption of young consumers will also benefit.

"Easy Sifang" Motor Tongda Power with Firewheels has a daily limit of 5 consecutive days.

It is worth mentioning that the recent performance of Tongda Power is quite eye-catching. Up to now, it has been trading for five consecutive trading days. The stock closed at 19.43 yuan today, with more than 47,000 orders on the daily limit.

Tongda Power recently said on the investor interaction platform that the company’s current products in the field of new energy vehicles mainly focus on the stator and rotor cores of driving motors. BYD is one of the company’s important customers, and the company also has many new energy automobile enterprise customers. At present, the company has full production capacity and sufficient capacity utilization rate. In the future, the company will focus on the projects of wind power generators and new energy vehicle drive motors, and increase development efforts.

Recently, BYD held a brand launch conference, launched millions of high-end models U8 and U9, and released a brand-new self-developed easy Sifang technology platform. It is reported that the "Easy Sifang" technology is the first mass-produced four-motor drive technology in China, which enables the automobile to accurately control the four-wheel dynamics of the vehicle by virtue of the four-motor independent vector control technology and creates a brand-new automobile safety technology system.

Some analysts pointed out that Tongda Power, which has soared recently, is the supplier of BYD motor stator core, and the most critical part of "Easy Sifang" is the motor. The rapid growth of demand for new energy vehicles has driven the drive motor industry to flourish.

Experts responded by advising people to take out one-third of their savings to buy a house: not forcing low-income families to buy a house.

According to Zhongxin Jingwei, recently, experts advised people to take out one-third of their savings to buy a house, which triggered a heated discussion. On the 11th, Meng Xiaosu, a well-known scholar, responded: "Some netizens said,’ Low-income families have no money, so what can they buy a house?’ In fact, they are not wrong. Low-income families suffered the most from the epidemic in three years, and their quality of life declined mainly. Therefore, it is not realistic to just say’ support the need to buy a house’ or’ strongly support the purchase of the first suite’. He believes that it is necessary to encourage residents who have the ability to pay to buy houses, so as to promote economic, employment and income growth and benefit low-income groups.

Meng Xiaosu said that he never thought it was right to force low-income families to buy commercial housing. Over the years, he repeatedly stressed that low-income families, new citizens and young families should be provided with affordable housing, including property-based housing and rental housing, instead of just buying commercial housing. To this end, we must speed up the improvement of the "dual-track housing system", the government should fulfill the responsibility of providing affordable housing, and state-owned enterprises should return to the security track as soon as possible.

Earlier, Meng Xiaosu said in a public interview: "The deposits of China residents have increased by 15 trillion yuan. If one third of them are taken out to resume the purchase of houses and decoration, will China’s economy not recover smoothly?" Subsequently, this view sparked a heated discussion on the Internet and boarded a hot search.

In this regard, Meng Xiaosu said that in the first 11 months of 2022, the sales of commercial housing in China was about 11.86 trillion yuan, and it is expected to be around 13.4 trillion yuan for the whole year, which is about 5 trillion yuan lower than the 18.19 trillion yuan in 2021. "It’s like cutting the bottom of the barrel, how can the economic operation not be affected? When I say’ take out 5 trillion yuan to buy a house’, I mean the lost 5 trillion yuan of housing sales. "

Does Paxlovid’s failure to enter the medical insurance catalogue affect the medical insurance in COVID-19? National medical insurance bureau responded

The the State Council Joint Prevention and Control Mechanism held a press conference on the 11th. Responsible comrades from relevant departments of the Ministry of Civil Affairs, the Ministry of Commerce and the State Post Bureau and experts from China CDC attended the conference, introduced the situation of epidemic prevention and control in key institutions and places, and answered questions from the media.

At the meeting, the reporter asked, Paxlovid made in Pfizer failed to enter the medical insurance catalogue through negotiation. Will it have an impact on the medical insurance in COVID-19?

In this regard, Huang Xinyu, director of the Medical Service Management Department of the National Medical Insurance Bureau, said that the National Medical Insurance Bureau has always attached great importance to the guarantee of medication in COVID-19. In 2021, we have formulated two medical insurance policies and included them in the payment scope in the catalogue. With the timely follow-up of the diagnosis and treatment plan, the scope of the medical insurance drug list was adjusted.

Huang Xinyu said that COVID-19’s therapeutic drugs have always been the focus of our attention. In the medical insurance catalogue negotiation in 2022, three COVID-19 therapeutic drugs were included in the negotiation, including Pfizer’s Paxlovid, which unfortunately failed. However, don’t worry too much. Just last week, the National Medical Insurance Bureau just formulated a notice to optimize the medical insurance policy for treatment expenses after the COVID-19 Class B Hospital, which clearly continued the policy of temporary payment for listed drugs in the existing diagnosis and treatment plan. The current payment will be made until March 31 this year, during which the patient’s medication will not be affected.

In addition, in the medical insurance catalogue, there are more than 600 kinds of drugs for treating colds and fever. It should be said that the insured has a rich choice of drugs. The National Medical Insurance Bureau is also paying close attention to the research and development progress of COVID-19’s treatment. It is known that some new drugs for COVID-19’s treatment have been put on the market one after another recently. We believe that with the increase of new drugs on the market, patients’ choice of clinical drugs and their ability to guarantee will be further improved. The National Medical Insurance Bureau will pay close attention to the price level of drugs used in COVID-19, do a good job in price monitoring and management, do a good job in ensuring the cost of COVID-19, and strive to reduce the burden on patients.

Eight guidelines for epidemic prevention and control in the cultural tourism industry are abolished

The General Office of the Ministry of Culture and Tourism issued a notice on the implementation of the "Class B Management" of novel coronavirus infection and the prevention and control of the epidemic situation in the cultural and tourism industries. It is mentioned that local cultural and tourism administrative departments should, in light of local conditions, formulate measures to prevent and control the epidemic situation in the industry after the implementation of "Category B Management" and measures to prevent and control the epidemic situation when it is serious, ensure that all epidemic prevention and control requirements are put in place, and ensure the normal development of cultural and tourism activities and the orderly flow of personnel. As of the date of issuance of this notice, eight guidelines for epidemic prevention and control in the cultural and tourism industries shall be abolished at the same time.

Proofreading: Zhao Yan

Live recommendation