Gold prices continue to skyrocket! Every gram approaches the daily limit of 730 yuan gold stocks! Some people spend millions on gold.

On the morning of the 8 th, the Shanghai Composite Index fluctuated in intraday trading and turned green near midday; The Shenzhen Component Index and the Growth Enterprise Market Index fell, and the Beizheng 50 Index fell more than 2%; Northbound funds sold nearly 3 billion yuan in half a day. As of midday, the Shanghai Composite Index fell 0.17% to 3,063.95 points, the Shenzhen Component Index fell 0.75%, the Growth Enterprise Market Index fell 0.96%, the Science and Technology Innovation 50 Index fell 1.24%, and the North Securities 50 Index fell 2.41%. The total turnover of the two cities was 600.7 billion yuan, and the net sales of northbound funds was 2.967 billion yuan.

On the disk, the power and non-ferrous sectors have risen strongly, while oil, coal,The automobile sector rose,Outbreak, rare earth,、The concept is active; Brewing,, construction, medicine and other sectors weakened.

In the early morning of April 8,The performance of the sector is weak. As of press time,Fall more than 5%,It fell more than 4%.Wait for many stocks to fall more than 4%.

Gold stocks rose sharply

It is worth mentioning that on the morning of April 8,Plate led the market, gold stocks performed particularly well. On the 8 th, it rose strongly in intraday trading. As of press time,Up more than 16%,、、Waiting for the daily limit,Up nearly 7%.

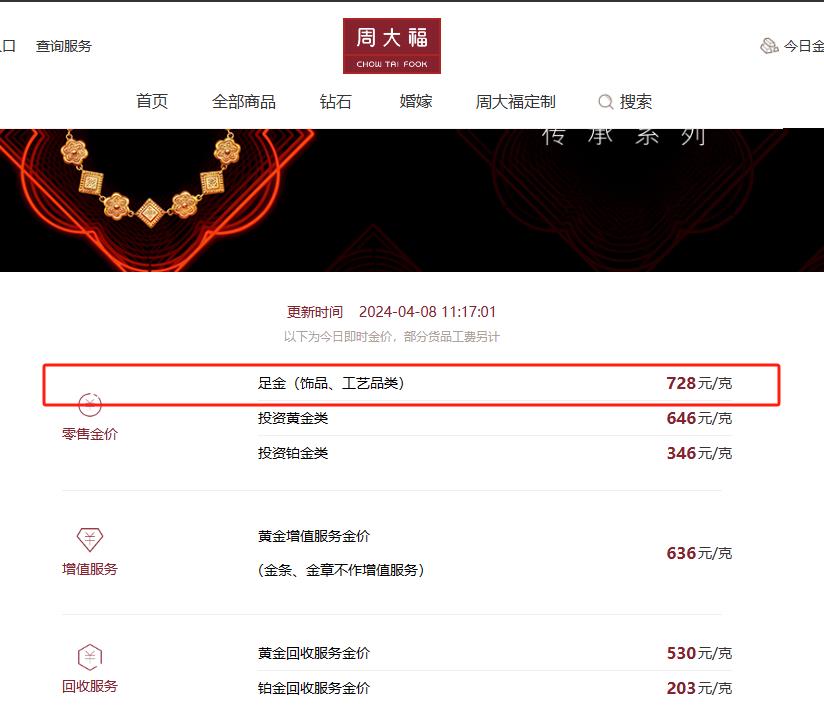

In the news, on Monday, domestic and international gold prices rose, the international gold price reached a record high, and the price of gold jewelry in domestic gold shops remained at a high level.The price of gold jewelry in gold shops has reached 728 yuan/gram.

Image source: official website screenshot

It is worth noting that it has been trading daily for five consecutive trading days. The company pointed out in the announcement on the evening of the 3rd that the company started to expand the retail business of gold products in August 2023, and it is estimated that the proportion of the company’s total revenue in 2023 will be 10.84%. The income source of the company’s main business in 2023 has not changed significantly, and it is still mainly inlaid jewelry business. After verification, the company’s daily operation is normal, the market environment or industry policies have not been significantly adjusted, the internal production and operation order is normal, no major contract has been signed recently, and the production cost and sales are normal. No media reports or market rumors that may or have had an impact on the company’s stock trading price were found, and no hot conceptual issues were found.

In terms of industry, domesticThe futures trend is strong, and the main contract of Shanghai Gold rose above 550 yuan/gram in intraday trading today, up over 2%, and continued to hit a record high; Shanghai Bank rose more than 6% and broke through 7000 yuan/kg.

During the Qingming holiday, LME metal and Comex gold showed a trend of accelerating upward breakthrough. Global manufacturing PMI expanded for three consecutive months and strengthened month by month, consumption improved and supply was constrained, and industrial metals maintained a strong momentum. The US economic employment data is resilient, non-agricultural employment greatly exceeds expectations, and the CPI decline in February is not smooth. Near the March CPI data release window, the market is betting on the logic of re-inflation, the US debt implies an increase in re-inflation expectations, superimposed geopolitical tensions escalate, and gold prices hit a record high.

people’s livelihoodIt is pointed out that in March, the US ISM manufacturing PMI and the number of non-agricultural new jobs exceeded market expectations, showing the resilience of the US economy. The unexpected performance of US economic data lowered the Fed’s expectation of interest rate cut in June, but the price of gold remained firm and upward, and short-term geopolitical tensions gave birth to safe-haven demand. In the medium and long term, the status of gold in the asset allocation of central banks around the world continued to rise, and the central bank’s purchases of gold continued to increase, which continued to be firm.The price of gold has risen, and at the same time, we should pay attention to the investment opportunities of silver at present. The ratio of gold to silver +PMI will resonate, and the price elasticity of silver is large.

Caixin Research Report pointed out that the Fed is getting closer and closer to cutting interest rates, the US dollar index fluctuated at a low level, and the real yield of 10-year US Treasury bonds declined. In the case of relatively stable long-term inflation expectations, there is limited room for the real yield of US bonds to rise in the future, and the inflation of major developed economies in the world is at a high level, and the gold price center is expected to continue to rise.

Men throw millions to buy gold

According to live TV broadcast and Beijing TV report, under normal circumstances, when people buy gold, they often choose carefully and carefully. However, some people are particularly generous, not only buying in large quantities, but also not caring about the style of goods. This abnormal shopping behavior caught the attention of the police.

The man wearing a cap in the picture is surnamed Yang, which is the third time he has come to the gold shop to spend money. On March 13, 2024, he bought 400,000 yuan of gold bars in a gold shop in a shopping mall in Daxing District, Beijing.He also said that he was going to buy millions of gold bars the next day, which aroused the vigilance of the clerk. The clerk said that when Yang bought gold bars, he brushed them card by card, and the whole process took more than an hour.

According to the Beijing News,On March 15, when the suspected man came to the gold shop again and spent more than 500,000 yuan to buy gold bars, he was arrested by the police who had been here for a long time."The card is not mine", "I came to buy gold bars for the boss" and "I don’t know the boss". In the face of the police’s inquiry, the suspect Yang honestly admitted what he had done.

Police officer Wei, who handled the case, said: "After that, this is repeated every time I shop by credit card, which is not like a normal process of buying goods. He seems to be waiting to receive instructions. According to our experience, the man’s behavior of buying gold bars in large quantities is not consistent with his actual spending power, so we suspect that he is helping fraudsters to use gold for money laundering. "

It turned out that Yang was a courier. Not long ago, he heard from a friend that he had a job with a daily salary of 500 yuan. As long as he took a different card to help him buy gold bars, he would get paid on the same day. Yang knew that such behavior was suspected of violating the law and committing crimes. Still taking risks.

At present, Yang was criminally detained by the police for allegedly concealing the crime of concealing the proceeds of crime and the proceeds of crime. The case is still under investigation.

Police officer Wei reminded: "Real-name registered documents such as bank cards and mobile phone cards can’t be rented, lent or sold to others for use, and you can’t use your own or others’ bank cards to help transfer unidentified money by withdrawing money or buying gold. Once the transferred money involves illegal crimes, it will become an accomplice of criminals and be severely punished by law."

The central bank is heavy! Continue to buy gold reserves and realize "17 consecutive increases"

Soaring! Gold prices hit record highs! The latest judgment is coming.

Multi-positive resonance "periodic table of elements" market hit "arrogant" gold stocks ushered in the main rising wave?

Will gold continue to shine? Wall Street bosses predict "next stop": $3,000!

China CITIC Construction Investment Co., Ltd.: Prices of precious metals and industrial metals broke through upward trend.