Headline reported today.

3,400 people, spent 10 billion, and "fought for Xiaomi car" for more than 1,000 days.

At 2 pm on December 28th, 2023, Xiaomi’s first car was finally unveiled by Lei Jun, founder, chairman and CEO of Xiaomi.

88 hours of publicity

This "grand meeting" of science and technology circles and bicycle circles officially kicked off four days ago.

On December 24th, Christmas Eve, Lei Jun sent Weibo: @ Xiaomi Auto at 10pm.

At 9: 00 a.m. on 25th, Weibo, the official of Xiaomi Automobile, released the first blog post, officially announcing the time and theme of the conference.

On the 25th, it was also the 1,000th day that Xiaomi announced the official construction of the car.

Before this, all kinds of news, spy photos, leaked photos and ID photos have stripped Xiaomi of his car. Lei Jun also said that "it is a great pity that there are always all kinds of leaks or rumors in the middle, which is really not our intention", and the team has been very low-key and pragmatic.

However, the enthusiasm and curiosity of rice noodles for Xiaomi cars have not decreased, but have been ignited by pictures and words that have been exposed again and again.

After the official announcement of the press conference, Weibo of Lei Jun began intensive publicity around Xiaomi Automobile.

On 25th, Lei Jun emphasized that "this time, only technology will be released, not products" and "Xiaomi Automobile will completely redefine the technology stack of the automobile industry, which will be a major leap in the technical field of the automobile industry".

This technology conference will be a comprehensive display of Xiaomi’s technology accumulation since its founding 13 years ago. Lei Jun predicted that "it will take a long time, so I hope everyone can prepare in advance".

On 26th, Lei Jun recalled the press conference that announced "Fighting for Xiaomi Automobile" three years ago. Lei Jun said that building an advanced mobile smart space is the mission of Xiaomi to build a car.

Lei Jun also answered several questions that netizens are most concerned about, such as the duration of the press conference and the origin of the name of Xiaomi SU7, and revealed the price information of Xiaomi car that everyone is most concerned about: "We haven’t made a final decision on pricing. However, Xiaomi SU7 is indeed a bit expensive. However, Lei Jun also stressed that "there are expensive reasons".

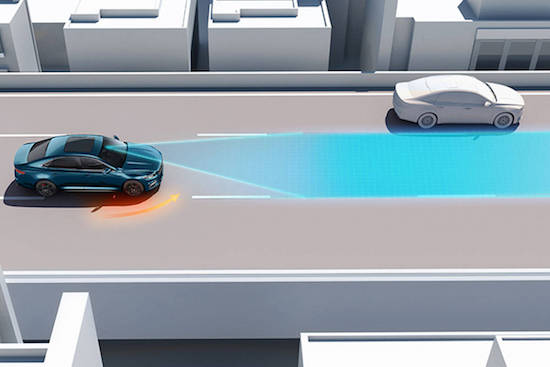

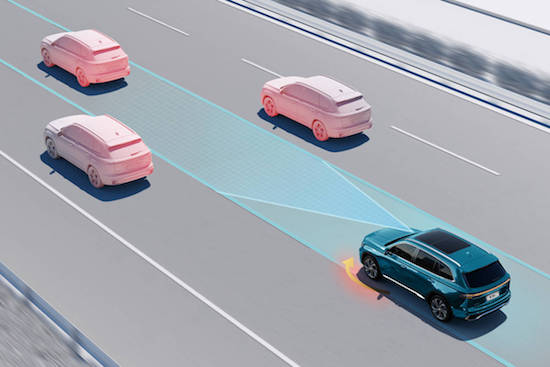

Intelligent driving has always been regarded as one of Xiaomi’s killer weapons. In August last year, Xiaomi’s autonomous driving technology made its debut. At that time, in the promotional video, Xiaomi was able to summon vehicles with one button, automatically navigate, automatically cope with some complicated car conditions, and independently parking service.

At that press conference, Lei Jun announced that the goal of Xiaomi’s autonomous driving is to enter the first camp of the industry in 2024, and the first phase investment of Xiaomi Automobile has reached 3.3 billion yuan.

On the 27th, Lei Jun not only promoted Xiaomi 澎湃 os and the whole ecology of people, cars and homes, but also launched the "tribute" series. Not only made posters, but also paid tribute to BYD, Weilai, Tucki, Ideality, Huawei and other car companies. In the evening, tribute lights were lit up in several cities.

There are several episodes here, in which BYD, Wei Lai, Tucki, Ideality and Contemporary Amperex Technology Co., Limited in Lei Jun’s words all responded enthusiastically. BYD also played the previous slogan "Together is China Auto".

However, Huawei’s terminal, which was attacked by Lei Jun at, didn’t respond, probably because it wanted to emphasize the difference between itself and Xiaomi again. Huawei doesn’t make cars.

However, some netizens thought that Huawei didn’t respond. Some netizens left a message in BYD Weibo, saying that "this is the leading brother".

Yang Xueliang, senior vice president of Geely, who was not at, was very active, sending several messages in succession, such as "Come on, although not saluted, we still open our chest to welcome new players in", "Too late", "I can’t understand", "2024 is the first year of salutation", "If people always want to be saluted, it will be over, but if people always want to salute others, there is no promise" and so on.

Yang Xueliang is so active, there may be three reasons besides the traffic of Xiaomi.

First of all, it may have broken some defenses without being named by Xiaomi. After all, Geely is also one of the world’s top 500 enterprises, and it is also vigorously transforming into new energy sources.

Second, it is said that Xiaomi Automobile has dug many lucky people, such as Hu Zhengnan, an executive of Xiaomi Automobile. Hu Zhengnan once held the positions of President of Research Institute, Senior Vice President and Director of Product Technology Management Committee in Geely Automobile. At this conference, some fans also expected President Hu to give a speech on stage.

Third, and most directly, last night was the launch conference of Krypton 007, but Xiaomi stirred it up. Earlier, we issued a document explaining the reasons why the top executives organized a group to visit Xiaomi. And when Yang Xueliang broadcast live on the press conference of Krypton 007 in Wentu last night, he also left a message saying, "We don’t compete with Xiaomi" and "(Xiaomi SU7) surpasses 007, try it".

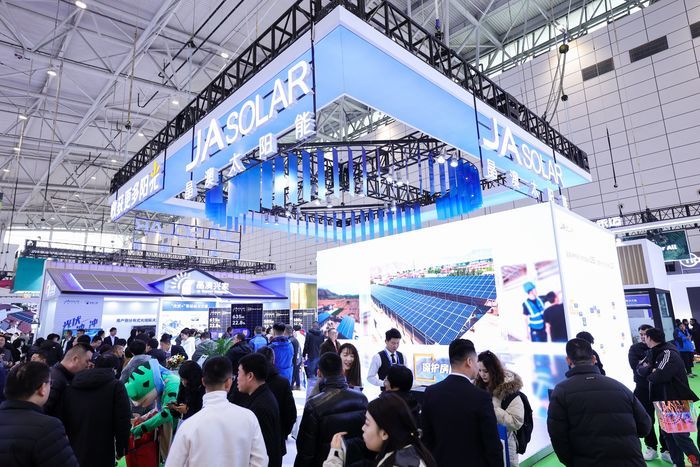

Xiaomi’s conference was also supported by many auto-related technology companies. Under Xiaomi Auto Weibo, Internet and auto parts manufacturers including Gaode Map, Cool Dog Music, Nexter Auto System and ZF (auto parts supplier) left messages in support.

This morning, at 6: 35, Lei Jun released Weibo’s "I was a little excited today and woke up early". At 12 noon, another set of photos of SU7 Bay Blue was released.

Everything is ready, just waiting for the afternoon conference.

3-hour press conference

Lei Jun comprehensively introduced the technology of Xiaomi Automobile from five aspects:

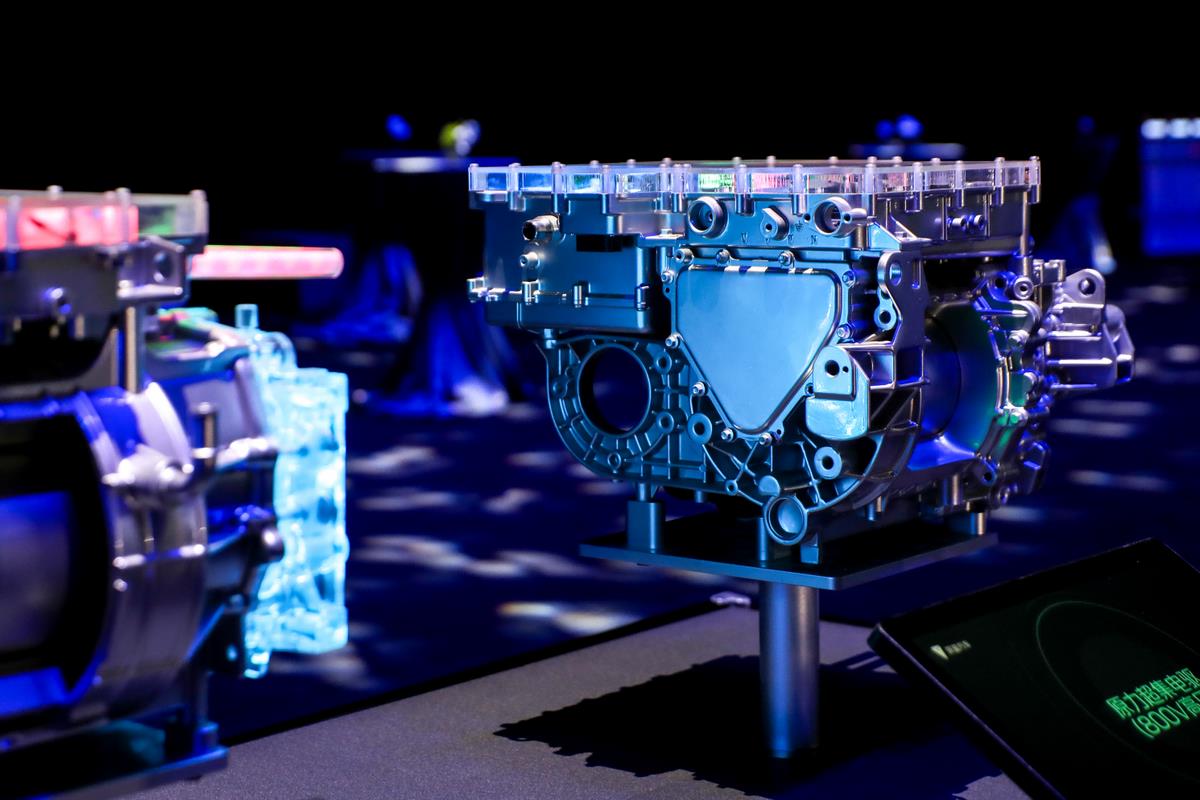

Super motor

Xiaomi released its own research and independently produced super motors.

Super motor V6 series, the speed can reach 21000rpm. On the first mass production model SU7, Xiaomi V6/V6s motors have been installed, which were jointly developed with UMC and Huichuan respectively.

Super motor V8s is made of high-strength silicon steel, with the strength as high as 960MPa, and adopts bidirectional oil-cooled heat dissipation technology, with the efficiency jumping by 50%.

The V8s has a maximum speed of 27200rpm, a maximum horsepower of 578ps, a peak power of 425kW, a peak torque of 635N.m, a maximum efficiency of 98.11% and a power density of 10.14kW/kg.

V8s is expected to be mass-produced in 2025.

The super motor in the experimental stage adopts carbon fiber laser winding process, and the pre-research in the laboratory has achieved 35000rpm, which is still some time away from mass production.

In the field of motor electronic control, Xiaomi has applied for 155 patents and authorized 60 patents.

Super battery

Xiaomi Automobile released an 800V carbonized high-voltage platform with a maximum voltage of 871V, which is "a real 800V high-voltage platform" and equipped with CTB integrated battery technology, with the highest volume efficiency of 77.8% in the world.

In terms of safety, Xiaomi battery has passed the most stringent thermal failure safety standards in the world, with 17 layers of high-voltage insulation protection, the largest cooling area of 7.8m2, and 165 pieces of aerogel insulation. Xiaomi Che Yun also cooperates with the security early warning system.

At the same time, Xiaomi Automobile adopts the industry’s first battery inversion technology to ensure the safety of the passenger compartment to the greatest extent.

Lei Jun said that Xiaomi Automobile is determined to be the king of electric vehicles in winter.

Xiaomi has built its own battery pack factory. In the field of batteries, Xiaomi has applied for 132 patents and authorized 65 patents.

Super die casting

Xiaomi is super die-cast, reaching 9100 tons, with full stack self-research and full link independent design. This figure also exceeds Tesla’s factories in Shanghai and the United States.

At the press conference, Lei Jun introduced Xiaomi Titan Alloy, a self-developed alloy material of Xiaomi, and said that Xiaomi Automobile is the only automobile factory in China with mass-produced self-developed alloy materials.

At the same time, self-developed structural design, 72-in-1 integrated die-casting rear floor and three-stage rear floor anti-collision design were also introduced.

Intelligent Drive

Intelligent driving is essentially AI. Xiaomi started all in AI in 2016 and currently has 3,000 AI engineers.

Lei Jun introduced that the investment in smart driving Xiaomi is determined. The smart driving team of Xiaomi Automobile has 1,000 people and 200 test vehicles.

Xiaomi’s full-stack self-developed intelligent driving technology, with a total investment of 3.3 billion yuan in the first phase, has now increased to 4.7 billion yuan, and its goal of autonomous driving is to enter the first camp in the industry in 2024.

Xiaomi Auto released auto-driving technologies such as zoom BEV, super-resolution occupation network technology and large road model, which will support three functions: high-speed navigation, urban navigation and parking service.

Lei Jun said that it plans to open 100 cities to pilot NOA by the end of next year.

Intelligent cockpit

Xiaomi Automobile Intelligent Cockpit is equipped with Qualcomm Snapdragon 8295 chip, based on surging OS technology, which is mainly composed of 16.1 central control ecological screen, flip instrument screen, 56 "HUD and rear expansion screen, and can realize five-screen linkage.

Lei Jun said that it has created an exclusive CarIoT ecosystem for Xiaomi Automobile. At present, CarIoT ecosystem is fully open to third parties. Apple users also have a good experience in driving Xiaomi car. Xiaomi car supports wireless CarPlay, AirPlay and even iPad, which can control the air conditioning, music and seats of the car.

Xiaomi 澎湃 OS officially got on the bus, and "the whole ecology of people and cars" was closed.

Xiaomi Auto officially released Modena’s technical architecture, and Lei Jun said that the design target is 100 "industry-leading" technologies.

Xiaomi automobile

Xiaomi SU7, which was almost stripped before the press conference, officially released the official map.

Xiaomi SU7, positioned as a C-class high-performance eco-technology car, is a car that Lei Jun hopes to be "comparable to Porsche and Tesla".

Xiaomi SU7 has three color schemes, namely "Gulf Blue", "Elegant Grey" and "Olive Green". With a length of 4997mm, a width of 1963mm, a height of 1440mm and a wheelbase of 3000mm, Xiaomi SU7 has the lowest drag coefficient Cd 0.195 for cars in the world.

Lei Jun also introduced Xiaomi SU7′ s drop-shaped headlights, light ring taillights, 175-degree ripple surface and semi-hidden door handles.

In terms of interiors, Xiaomi SU7 has introduced three models, namely Galaxy Grey, Twilight Red and Obsidian Black. In addition to the five screens mentioned above, it is also equipped with a wraparound cockpit, a suspended instrument panel, a 5.35㎡ vehicle glass surface and a three-spoke D-shaped steering wheel.

Xiaomi SU7 has a C-class large space, 1012mm front vertical seating space and 105mm rear knee space; 517L trunk, China pure electric vehicle maximum 105L front case.

Xiaomi SU7 has a zero acceleration of 2.78 seconds, a zero braking of 33.3 meters and a top speed of 265 km/h..

In terms of battery life, Xiaomi SU7 is equipped with Xiaomi-Contemporary Amperex Technology Co., Limited battery, with a battery capacity of 101kWh, a cruising range of 800km under CLTC condition and a battery life of 220km after charging for 5 minutes. At the same time, it has good low-temperature performance.

In terms of safety, Xiaomi automobile adopts the armored cage steel-aluminum hybrid body design, with high-strength steel and aluminum alloy accounting for 90.1%, the highest strength reaching 2000MPa, and the torsional stiffness of the whole vehicle reaching 51000 N m/deg. Xiaomi Automobile has completed 40+ crash tests and is equipped with 7 airbags.

In addition, Xiaomi is equipped with 16 active safety technologies, including self-developed active safety simulation verification system and self-developed "4D space-time labeling" technology.

The price of Xiaomi SU7 has not been announced yet. However, when Lei Jun introduced the SU7 battery, he said, "Don’t pay 99,000 yuan, don’t pay 149,000 yuan." "There are more than 100,000 battery packs. What are you thinking? 」

1003 days

Lei Jun said that Xiaomi Automobile is already in small-scale mass production, but it will take another few months and a lot of verification before it can be officially released.

On March 30, 2021, Lei Jun officially announced Xiaomi to build a car at the press conference. At that time, Lei Jun’s cold was very serious, his voice was hoarse, and his speech was very difficult, but he still insisted on finishing the whole press conference.

After that, every dynamic of Xiaomi Automobile was put in the spotlight. For example, the official application for the trademark of Xiaomi Automobile, the acquisition of Shendong Technology, the incorporation of Xiaomi Automobile Co., Ltd. and the photo of 17 core members, the production base of Xiaomi in Yizhuang, and various leaked news in the later period.

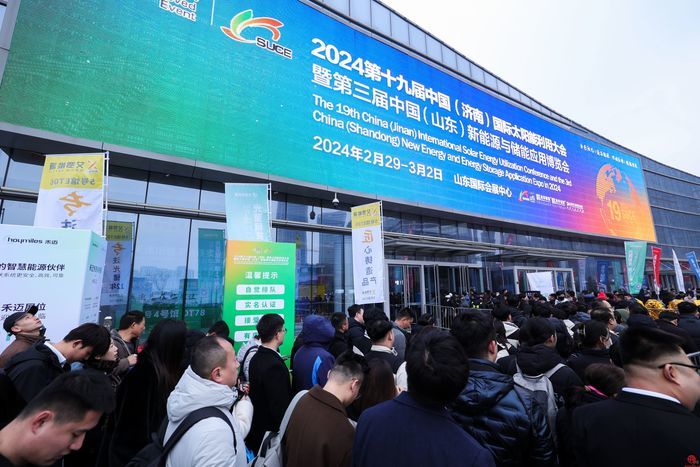

Today, the Xiaomi Auto Conference was held in Beijing National Convention Center. "From Beijing Xiaomi Science and Technology Park to Beijing National Convention Center, the straight-line distance is just over 20 kilometers, and we walked for 1003 days."

"Through 15-20 years’ efforts, we will become the top five automobile manufacturers in the world and strive for the all-round rise of China’s automobile industry. This is Lei Jun’s long-term goal for Xiaomi Automobile.

But at the moment, Xiaomi Automobile will face many challenges. For example, whether the final pricing can satisfy users, how much sales can be achieved next year, and even the proud autonomous driving has already become a compulsory course for various new energy manufacturers.

And the new energy battlefield has also been fierce. Xiaomi car jumping from one red sea to another, "is it too slow?"

But in any case, Xiaomi Automobile has shown its own strength and determination to "lead in an all-round way" and officially participated in the competition in the new energy market.

When the horn sounded, the war was on the verge.