After scolding "cutting leeks", Wang Bicong threw 2 million to buy Jia Yueting’s new car

Original, Team Author, Shuaizhen Business Vision

Why did Wang Sicong jump into the "fire pit" when he knew that the other party was a liar?

Produced by Shuai Zhen Business Vision (ID: ailishi777)

A few days ago, Jia Yueting made a rare appearance at the China Auto Blue Book Forum and participated in the meeting by video link. This is his first public appearance in China since he left the United States for six years.

In the video, Jia Yueting wears a signature smile, with an assembled FF91 parked behind him, to prove to the outside world that the FF91 is really mass-produced.

The first batch of FF91s in mass production in the United States has been delivered to car owners, most of whom are Wall Street executives or Hollywood stars.

The appearance on the domestic auto forum this time is clearly Jia Yueting’s preparation for the sale of FF91 in China. According to people familiar with the matter, China’s first FF91 owner is the famous "national husband" Wang Sicong.

Anyone familiar with Wang Sicong knows that he rented a garage at the Peninsula Hotel in Shanghai, where more than 20 luxury cars, including Ferrari, Lamborghini, Rolls-Royce, Bentley Mulsanne, Maybach, and limited-edition Porsche, are parked, with a total value of over 100 million yuan.

Only there are no electric luxury cars.

This time, Wang Bicong threw 2 million to buy Jia Yueting’s new car, which is a bit confusing. You know, he once publicly criticized Jia Yueting on Weibo as a "liar who cuts leeks".

Why did Wang Sicong jump into the "fire pit" when he knew that the other party was a liar? The story starts with an investment made seven years ago.

01

Jia Yueting used to be the God of Wealth of Wang Sicong.

In 2009, after Wang Sicong returned from studying abroad, Wang Jianlin always wanted to train him as a successor and take over the then-thriving Wanda Group.

Wang Sicong has his own ideas. He doesn’t want people to say that he is a rich second generation of "fighting father", and wants to break out-point himself.

Therefore, Wang Jianlin gave Wang Sicong 500 million yuan as the capital base for starting a business and agreed: "This 500 million yuan loss is fine, I will give you another 500 million yuan, but if you lose again, you will honestly go back to Wanda to work."

Wang Sicong took the 500 million yuan given by his father and established an investment company called "Pusi Capital", looking for small companies with potential all over the world.

In his opinion, it is too hard for his father to make money by building a building. Real entrepreneurs should learn to let others make money for themselves.

The person who helped Wang Sicong make money was Jia Yueting.

At that time, Jia Yueting had unlimited scenery in the capital markets, holding the two major industries of LeTV film and television and LeTV sports.

Under the guidance of his wife Gan Wei, Jia Yueting turned Zhang Yimou, Guo Jingming, Sun Honglei, Huang Xiaoming, Li Bingbing, Sun Li and other celebrities into LeTV shareholders.

The famous LeTV has attracted the attention of Wang Sicong. In 2015, he invested 100 million yuan in LeTV Sports, accounting for 11% of the shares and becoming the largest shareholder.

Jia Yueting did not disappoint Wang Sicong. Under the superb capital operation of the former, LeTV Sports only took one year, and the valuation soared from 2 billion to 20 billion, which expanded by 10 times. Wang Sicong did nothing, just made 2.20 billion!

After 2017, there were a lot of self-media on the Internet, saying that Wang Sicong was not only handsome, but also very powerful. It took a few years to turn the 500 million yuan given by his father into 5 billion yuan. As expected of the "national husband" that every woman wants to marry.

In fact, Wang Sicong just followed the trend and voted for LeTV, which is no different from the "chasing high" of ordinary investors.

02

When Wang Sicong was immersed in the vanity of "national husband", Guo Taiming, the real business boss, had sensed that LeEco was going to die.

The reason was that Jia Yueting held a "buy a member and get a color TV" activity, which caught the home appliance factory by surprise. Huang Hongsheng, the boss of Skyworth, said that he had dealt with color TVs all his life, and he never dreamed that one day he would buy a color TV for free!

Under the free offensive, LeTV color TV surged forward, with annual sales reaching 6 million units, becoming the fourth largest color TV brand in the country. LeTV’s share price rose with the tide, and its valuation reached 160 billion.

Jia Yueting wanted to seize control of the color TV industry and began a series of merger plans.

He first set his sights on Skyworth and invited Huang Hongsheng to a Beijing palace for dinner. During the dinner, Jia Yueting opened two bottles of 82-year-old Lafite. After three rounds of wine, Jia Yueting stated the purpose of the dinner: he wanted to buy 30% of Skyworth’s shares at 1.5 times the price.

Huang Hongsheng is excited, which means he can cash out billions at a time.

But Mr. Jia added: LeEco will pay $100 million first, and the rest will be paid within nine months. He then produced a letter of intent for Mr. Huang to sign.

Huang Hongsheng was not drunk and said that he was not in a hurry to sign the contract. He would wait until he went back to discuss with the team.

This decision saved Skyworth.

A few days later, Huang Hongsheng received a call from Guo Taiming and also made an appointment for dinner. At the dinner, Guo Taiming said straight to the point, "I heard that Jia Yueting talked to you about the acquisition?"

Huang Hongsheng explained the situation. Guo Taiming pointed and said, "He also talked to me about buying a TV brand in my hands."

What makes Guo Taiming puzzled is that Jia Yueting’s 100 million deposit has been on the account for 8 months, why did the balance not arrive?

Guo Taiming asked Huang Hongsheng, "Do you think Jia Yueting has so much money?"

The answer is no. At the moment, LeEco’s funds are extremely tight, and there are only five months left before the collapse.

Afterwards, Huang Hongsheng rejected Jia Yueting’s acquisition offer. Guo Taiming also cancelled the deal because he did not receive the balance, earning a deposit of 100 million in vain.

Capital that sensed something was wrong began to secretly sell off LeEco’s shares. Wang Sicong, the "son", was still in the dark, and his daily concern was "Which girlfriend do you want to hang out with today?"

03

In April 2017, the LeTV empire began to disintegrate; in July, it was revealed that there were problems such as exaggerated profits and false sales; in October, Jia Yueting resigned as chairperson and went to the United States, but has not yet returned.

Wang Sicong woke up like a dream, not only did the 2 billion he earned in the early stage disappear, but even the principal of more than 1 billion was wasted.

The bad news doesn’t stop there.

In 2019, Panda Live, which he invested in and served as CEO, declared bankruptcy after losing the money-burning war, leaving 1 billion debt black hole.

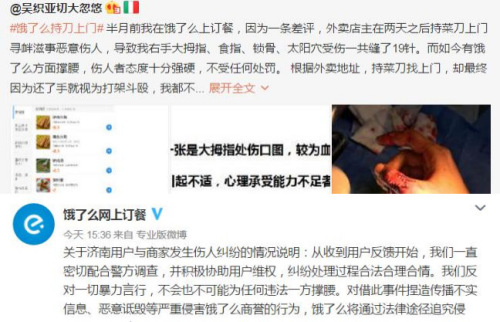

Then, the entertainment company "Banana Project", which he founded, lost orders from Tencent, got into trouble, and was sued by many creditors. Wang Sicong became "Lao Lai".

A company screenwriter even knelt down to Wang Sicong in order to ask for 800,000 royalties. But only in exchange: "Go to court and sue me!"

After a series of blows, the once-famous Pulse Capital lost all its "underpants". "National husband" was suddenly beaten back to its original form and became synonymous with playboy.

The unwilling Wang Sicong took Jia Yueting to court again, demanding Jia Yueting to compensate 100 million yuan on the grounds that LeTV Sports violated the agreement.

The court upheld Wang Sicong’s request.

It is said that Jia Yueting contacted Wang Sicong privately to ensure that he would be responsible for the debt to the end, and promised to give him one when FF91 was mass-produced.

6 years later, Jia Yueting’s situation is improving. More than 20 billion in debt, he has paid more than 10 billion, only owe 9.80 billion. Wang Sicong’s 100 million probability has been paid off.

Therefore, the two repaired their relationship. Only then did the news come out that Wang Sicong bought FF91. Jia Yueting, who made a comeback, proved his ability.

Wang Sicong was courteous, and it was not surprising to buy an FF91 to support him. After all, there are no eternal friends in the mall, only eternal interests.

END

Original title: "After scolding" cutting leeks ", Wang Bicong threw 2 million to buy Jia Yueting’s new car"

Read the original text