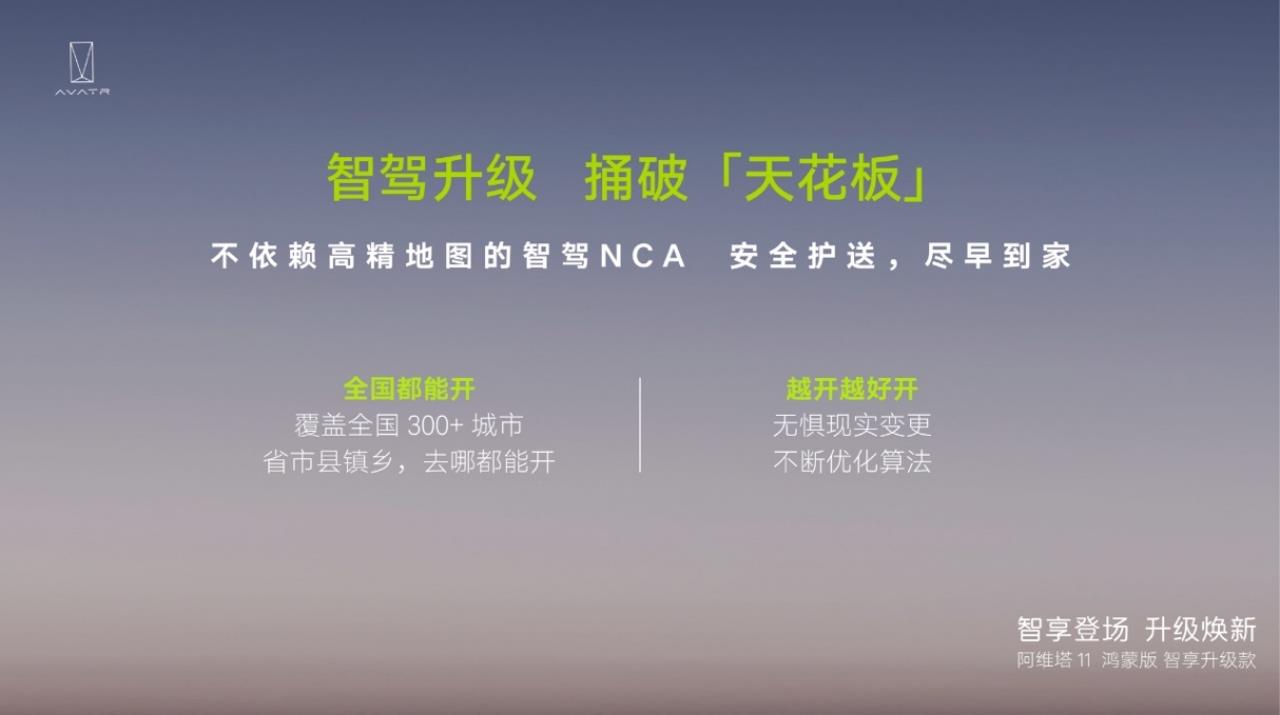

There is no need to press the "map" to upgrade the smart car, and the Aouita 11 HarmonyOS version of the smart car upgrade is listed.

On January 8th, Aouita 11 HarmonyOS version of Zhixiang upgrade was officially launched. The car has mainly undergone four upgrades: intelligent driving upgrade, equipped with map-free NCA function that does not rely on high-precision maps; Comfort upgrade, four somatosensory optimizations; Chassis upgrade, adding Huawei iTRACK function; The rights and interests are upgraded, and the "intelligent" highest rights and interests can be enjoyed for life. Moreover, there is no price increase in the whole department, and the prices of 90-degree rear-drive version 300,000 yuan, 116-degree rear-drive version 335,000 yuan, 90-degree luxury version 350,000 yuan and 116-degree luxury version 390,000 yuan remain unchanged.

With the launch of the car, Aouita has entered the era of intelligent driving with "de-high-precision mapping", effectively making up for the shortcomings of the intelligent driving scheme with high-precision maps, not only solving the pain point of "following the map", but also unlocking more high-frequency intelligent driving scenes. It is reported that its urban NCA intelligent driving function will unlock more than 300 cities at one time, bringing users a travel experience of "all the country can open and all the country can open".

Thanks to the industry’s top-stream vehicle-side perception and calculation ability brought by three laser radars that are fully equipped at the beginning, Aouita 11 can land quickly without relying on the intelligent driving NCA function of high-precision maps. Aouita 11′ s intelligent driving system integrates the Road Topology Reasoning Network (RCR) and the industry’s first GOD network to build real-time road information, identify all kinds of obstacles sensitively, and improve the safety of human driving and intelligent driving.

Aouita 11′ s intelligent driving system can make rapid and reasonable vehicle movement planning and path planning, and its driving style is more "human-like". In case of repairing subway, tidal lane, temporary road changes caused by traffic control and other scenes, the intelligent driving system can make up for the difference of iteration period of high-precision maps, and truly drive with or without maps, and the complex road conditions will not be degraded. In response to daily commuting and self-driving cross-provincial travel scenarios, the intelligent driving system can independently choose roads with higher traffic efficiency.

Combined with user feedback, the car has also been optimized for the leg, waist, back and sitting posture of the seat, so that users can have a comfortable experience no matter which seat they are in or which sitting posture they take. At the same time, the chassis of the car is upgraded with Huawei iTRACK architecture, which can realize ultra-fine road condition perception of 10,000 times per second and real-time adjustment of torque of 1,000 times per second, so as to realize the best power output mode under different road conditions and create the best driving experience.

Huawei’s iTRACK function "makes the road smooth". Aiming at the most common speed bump scene in daily life, Huawei iTRACK accurately identifies the wheel speed fluctuation, and adjusts and controls the torque within milliseconds to achieve rapid convergence. Through the actual measurement, the wheel speed fluctuation can be reduced by 50% and the aftershock time can be shortened by 40%, thus effectively improving the comfort and safety of the whole vehicle and bringing better driving experience to users.

The rights and interests are easy to upgrade. From now until February 29, 2024, car buyers can choose one of the following rights and interests: rights and interests 1. Users who buy cars after January 8 will be given a high-end smart driving bag worth 26,000 yuan; Second, during the activity, car buyers can enjoy the discount of paying a deposit of 5,000 yuan to offset the car payment of 25,000 yuan. In addition, Aouita also introduced more car benefits in a limited time, including: the first car owner’s lifetime three-electricity warranty; 6000 yuan replacement subsidy; Give away the intelligent fragrance system; The down payment starts from 42,000 yuan, and the full-term ultra-low interest financial concessions.

Upstream news Wu Jian